Download Deposit Statement

- Navigate to Operations > Payouts

- Double-click the Batch ID to download the deposit statement

Adjust Sync Settings

Tip: Consider syncing invoices to QuickBooks when they are ordered instead of delivered. This will ensure that your invoices have already been synced to QuickBooks prior to recording deposits against those invoices. Any changes to invoices in My Fundraising Place will still sync to QuickBooks the next time you run the sync agent.

To change when invoices are synced to QuickBooks, navigate to Settings > Dealer > Settings > Find the setting titled “Sync invoices to QuickBooks when invoice is” and change to Ordered.

Record Deposit in QuickBooks

- Open and run QuickBooks Sync Agent

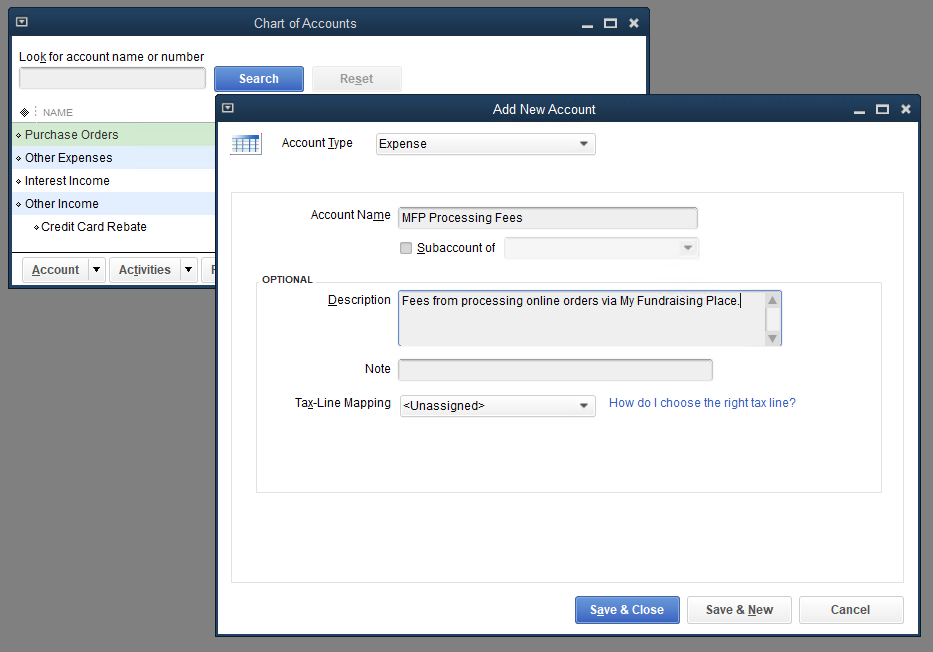

- In QuickBooks, open your Chart of Accounts (Ctrl + A) and create a new Expense Account titled “MFP Processing Fees”

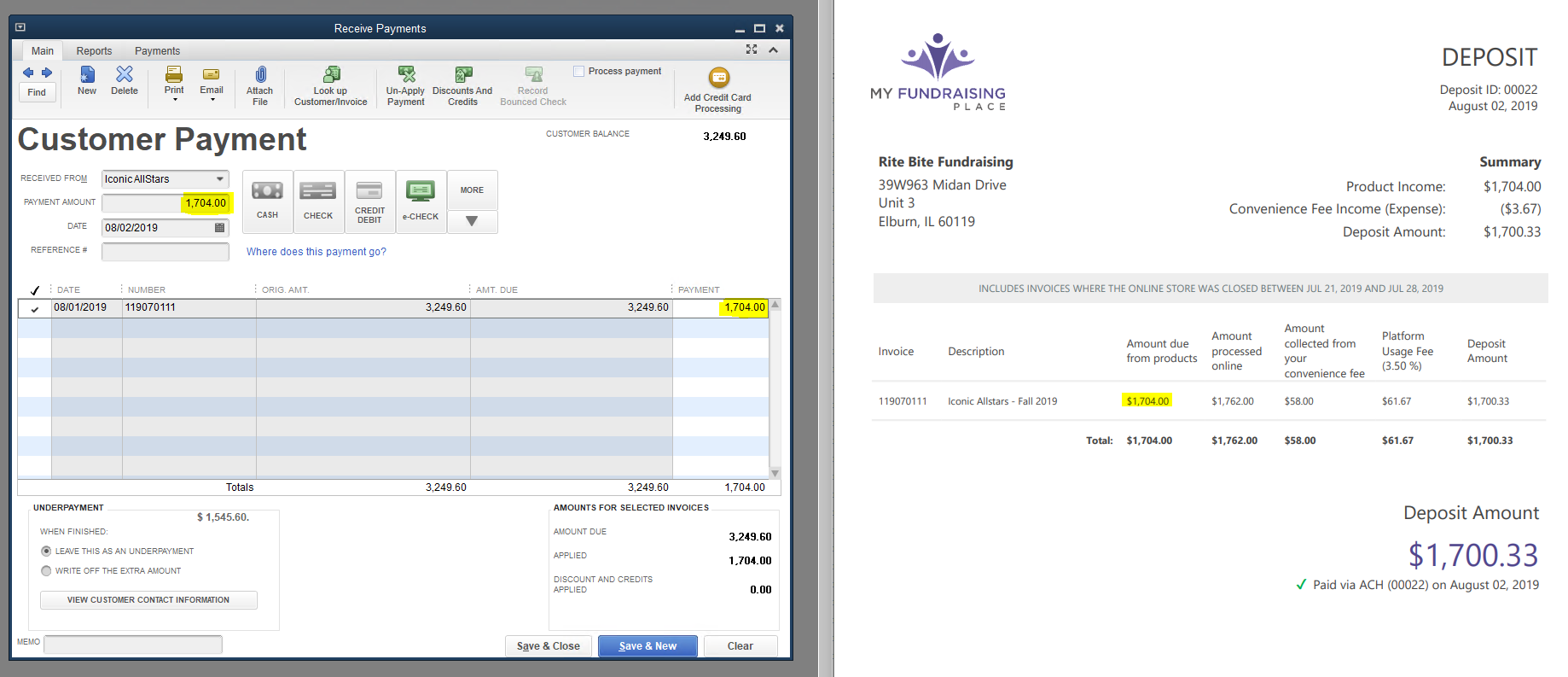

- From the Customers drop down menu, click Receive Payments

- Using the Amount due from products column on the Deposit Statement, receive payments for all invoices

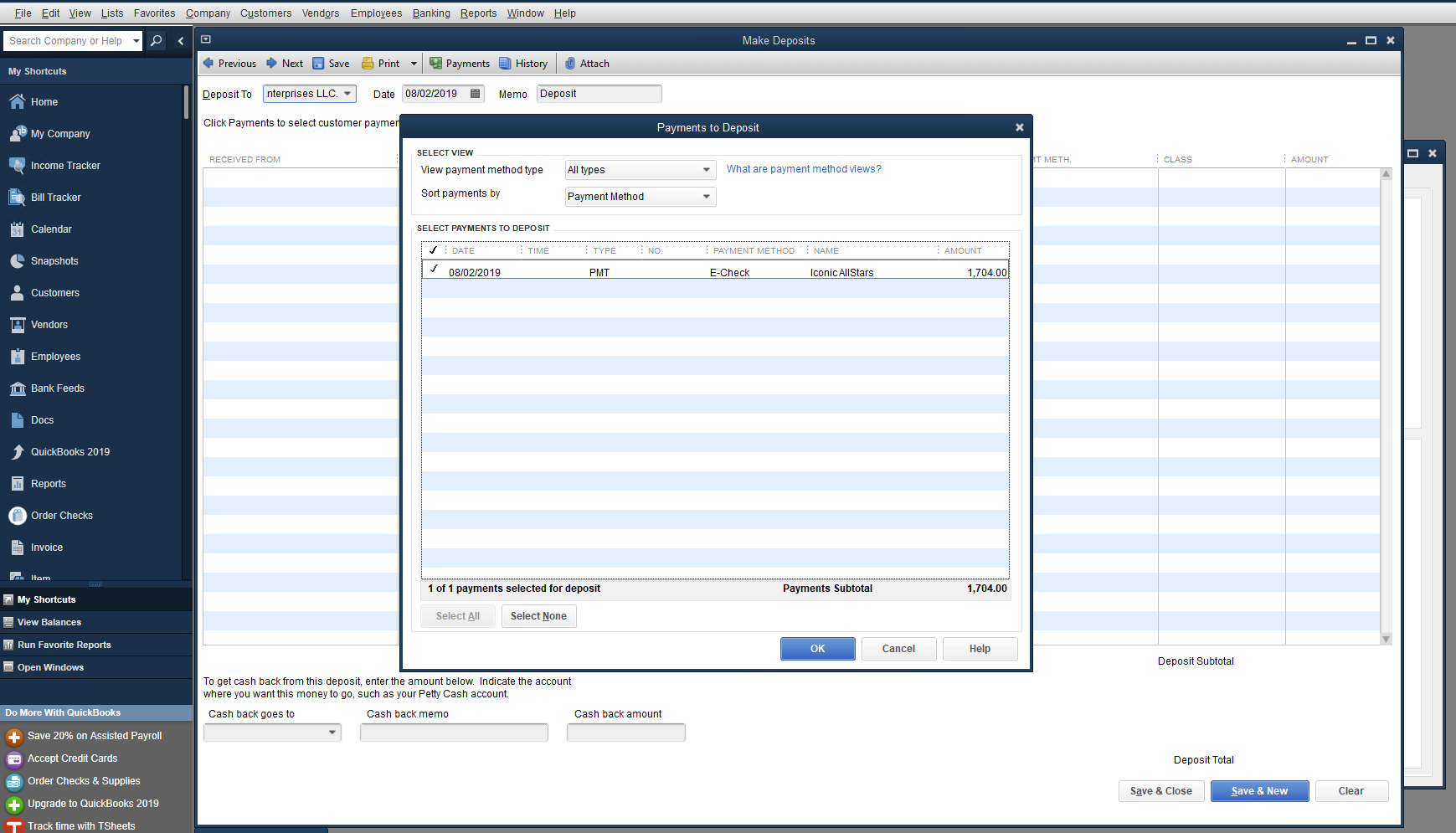

- From the Home window in QuickBooks, click Record Deposits

- Select the payments you’d like to deposit and click OK

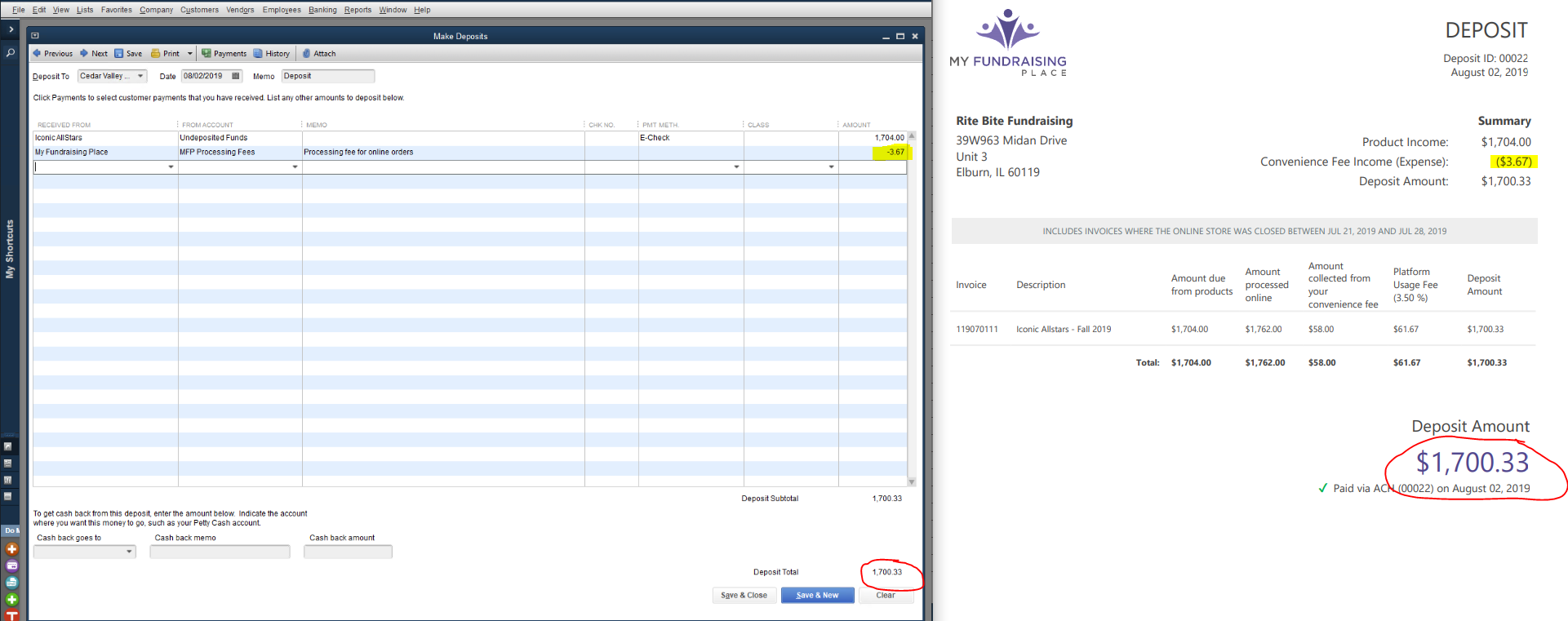

- On the following page, record the net convenience fee income (or expense) under your new Expense Account “MFP Processing Fees”

- Click Save & Close

If the customer has overpaid, you will need to write a check to the group for their profit.